The question of cost is the first thing most homeowners ask when considering a solar panel installation. To put it simply the cost of a solar system has many factors, and understanding them makes it clear why there has never been a better, more affordable time to go solar.

Every homeowner wants to know how installing a solar system

can reduce their monthly bills, and create tangible savings.

If your monthly electric bill averages $60 or more, your home is a good candidate for saving money with solar. Your solar consultant will provide a detailed custom quote.

Solar panels are designed to offset the power you are paying the electric company for. When your panels replace all the energy you used in a given month, your bill is reduced to

only small fixed costs.

The difference between the loan payment and the reduced electric bill create your monthly savings when financing your solar system. Monthly savings when you pay cash are from your reduced electric bill.

One of the key aspects of saving money with solar power is that systems are designed to meet your home’s average annual power usage. This accounts for natural seasonal variability in solar power production, and allows your system to save you money all year round.

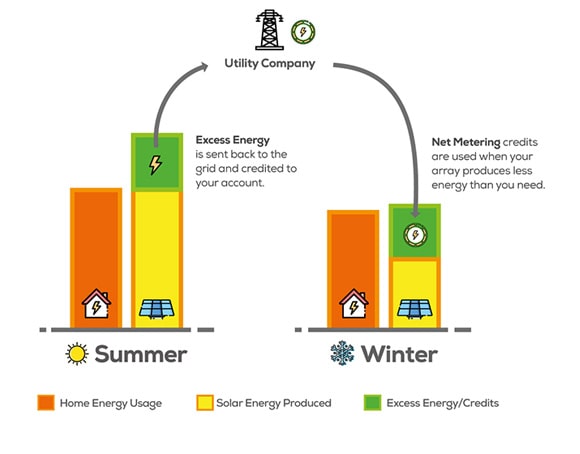

In summer, your solar panels typically produce more power than your home needs.

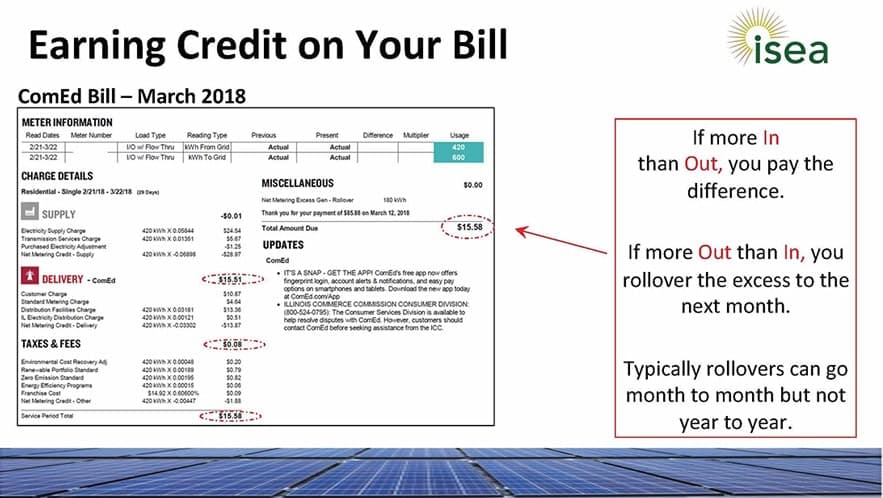

The extra power is sent back to the grid, and your utility gives you net metering credits.

Net metering is like storing your extra power in a credit battery until you need it for winter.

This allows you to enjoy a steady savings from your solar panels all year long.

In winter, your solar panels may not produce as much power as you use.

The additional power is drawn from the grid, and your net metering credits are applied toward the cost.

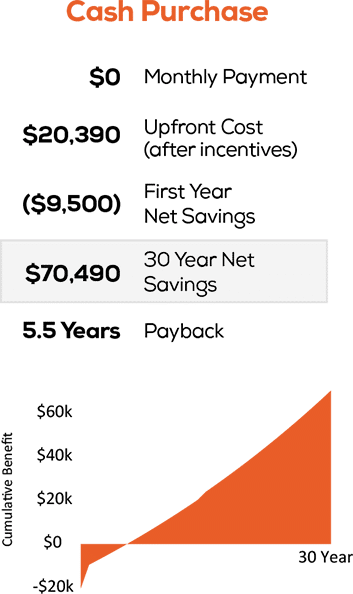

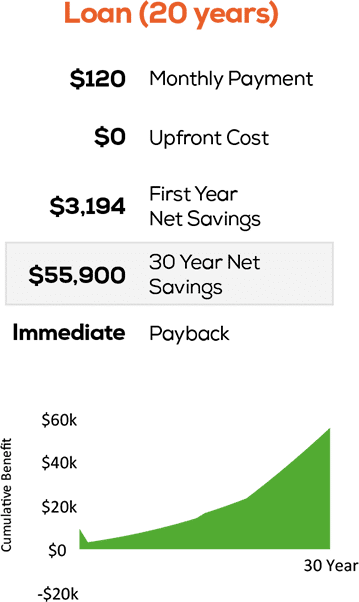

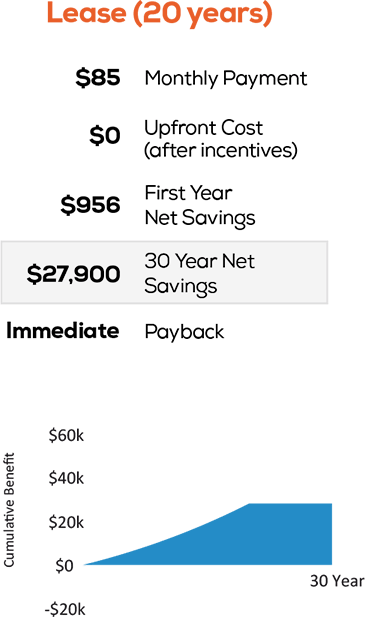

You can save money by going solar, but the long term savings will

vary depending on how you choose to finance your solar system.

These examples illustrate the long term savings potential for each

financing option.

When you pay cash up front for your solar system, your savings includes:

When you finance your solar system, your savings includes:

You can apply the incentives to your loan balance when you receive them with no prepayment penalty.

When you lease your solar system, your savings includes:

The leasing company owns the system, so they receive the incentives.

Solar incentives are state and federal programs that can lower

the initial cost of a solar system installation by up to 60%.

Solar incentive programs are applicable to you as a homeowner when the system is purchased with cash or financed with a loan. With a leased system, the lease company benefits from the incentives because they incurred the initial cost of the system and continue to own it.

Solar incentives are paid post installation, and the homeowner can then apply them to the loan balance, which effectively lowers the total initial cost.

The SREC incentive is a state program paid as a lump sum upon installation. Our financial partners offer plans with no prepayment penalties, so if you don’t purchase your system with cash you can choose to apply this incentive directly to your loan to reduce the balance.

Learn more about the Illinois SREC incentive and how SREC value is determined.

The ITC is a federal income tax credit calculated as a percentage of the total cost of your solar system installation. Any tax refund this generates can be applied without prepayment penalty to your loan balance. This credit is temporary and is expected to be phased out by 2021.

Learn more about the Federal Solar Income Tax Credit.

State and federal incentive programs are currently offering the best savings possible, but this savings level will not last long.

Learn more about why now is the ideal time to go solar if you want to maximize your savings potential.

This example shows how incentives and utility bill reduction impact

costs for an average residential solar system to create substantial

short and long term savings.

Solar does more than pay back your initial investment and create long term savings. It also increases your home’s value. And with the initial cost reductions from incentives, your home’s value can potentially increase by double your investment.

The average monthly savings from prior electric bills is $100 per month.

For homeowners that choose to finance their solar panels, loan terms are selected so the utility savings offsets the payment.

On average, solar panel loans are paid off within 12 years. The savings homeowners see during the life of the loan, and the higher savings after the loan period ends, all contribute to the growth of your long term savings.

Get an instant estimate for your location with our Solar Savings Calculator

discover savingsLearn more about the financing options your RxSun solar consultant can connect you with.

compare financing